Creating the First Global “Full Reserve” Federally Chartered U.S. Bank

OPPORTUNITY

Creating Analog Bank

We are creating the first global “full reserve” federally chartered U.S. bank focusing on individuals and corporations with account balances above the FDIC insurance limit. A bank where you know your money is “in the vault” so you can sleep well at night knowing your money is secure.

Analog will be a new "full reserve" bank offering a different, more secure banking approach. Unlike traditional banks, which hold only a fraction of deposits in reserve, this bank will be safer with 100% backed demand accounts. This means funds are safe and accessible. By not lending out customers demand deposits, the bank mitigates risks associated with systemic regulatory lapses and potential economic downturns, removing the risk of bank runs and ensuring peace of mind.

We believe there is an opportunity to create a U.S. bank that is financially stronger, safer, and customer focused.

YOUR WEALTH, LIQUID

YOUR FUTURE, SECURE

INVESTOR DECK

MOST COMMON QUESTIONS?

How is a "full reserve" bank different from my regular bank?

Banks today typically operate on a fractional reserve basis, holding a portion of customer funds while lending out the remainder. Fractional reserve banks regularly lend 90% of customer deposits. This is what makes it "fractional reserve" because the bank only has approximately 10% of their customers' money available for immediate withdrawal. In contrast, a "full reserve" bank has 100% of demand deposit account funds available for withdrawal because that money is never used for loans. This approach separates the safekeeping of deposits from lending activities, ensuring liquidity for depositors.

What is a Demand Deposit Account?

A demand deposit account is the formal banking term for a standard checking account. Its name comes from the core feature that you can withdraw or "demand" your funds at any time without prior notice, whether through checks, debit card transactions, or electronic transfers.

How does Analog make money without loaning demand deposits?

The U.S. government pays interest on money banks store at the Federal Reserve. The Federal Reserve's current Interest on Reserve Balances (IORB) is 4.40%. Additionally, we will hold assets in a mix of U.S. dollars, short-term U.S. treasuries, and other liquid equivalents.

How else would the bank make money?

In addition to generating revenue on reserve balances, our bank charter allows us to offer loans and credit. Instead of loaning customer demand deposits we fund loans from the banks balance sheet capital. We will earn approximately 100 basis points each time we issue a loan. We also build recurring income by charging an annual loan servicing fee of 30 basis points on outstanding loans.

Other streams of revenue include asset management, interchange, and transmission fees. Furthermore, our cash management services for CDs and treasuries provide another steady revenue stream at 30 basis points annually. These fee-based services ensure profitability without relying on customer deposits for lending.

How does Analog make money in a lower interest rate environment?

In a lower interest rate environment, our revenue from Interest on Reserve Balances (IORB) would decrease. However, these same lower rates make borrowing more attractive for customers, which significantly increases the velocity of our loan originations. The higher volume of loan origination and servicing fees is designed to compensate for the reduced interest earned on our reserves. This dynamic allows us to maintain a comparable return on assets, ensuring stable performance regardless of fluctuations in the broader interest rate environment.

Are you a digital-only bank or do you plan to have physical branches?

While we embrace a digital-first mindset to provide seamless and convenient access to our services, we are not a digital-only bank. We firmly believe in the value of personal relationships and community presence, which is why we plan to establish physical branches within the United States. These locations will serve as hubs for personalized financial advice, complex transactions, and building trust directly with our customers. Our model is designed to be the best of both worlds, augmenting the tangible experience of a physical branch with the efficiency of modern digital banking.

For our physical locations we are partnering with the Gilmore Group. The Gilmore Group designs novel branch experiences. They are the creators of Capital One Cafe, and various modern branches for Bank of America, UBS, Wells Fargo, and JP Morgan Chase among others.

Why don't US banks usually provide interest on checking accounts?

Traditional U.S. checking accounts offer negligible interest rates, often less than 0.1%. Bank profit models rely on lending out customer deposits. While banks offer an average savings account yield of 0.38%, these rates are treated differently from checking accounts. Banks generally use savings deposits for long-term lending, and during a financial crisis, banks can restrict or delay withdrawals from these savings accounts. The value proposition of an Analog demand account is access, security, and peace of mind.

What if a client wants yield products?

For clients seeking yield, we offer Money Market Accounts (MMA) and Certificates of Deposit (CDs), which provide a secure and predictable return on their capital. These time-bound deposits are a natural fit within our banking structure, offering competitive rates benchmarked against secure assets like U.S. treasuries. Recognizing the need for a broader range of options, we also plan on pursuing the required licenses to provide asset management services after the bank opens. This will enable us to offer our clients direct access to a wider array of financial products to meet their yield objectives.

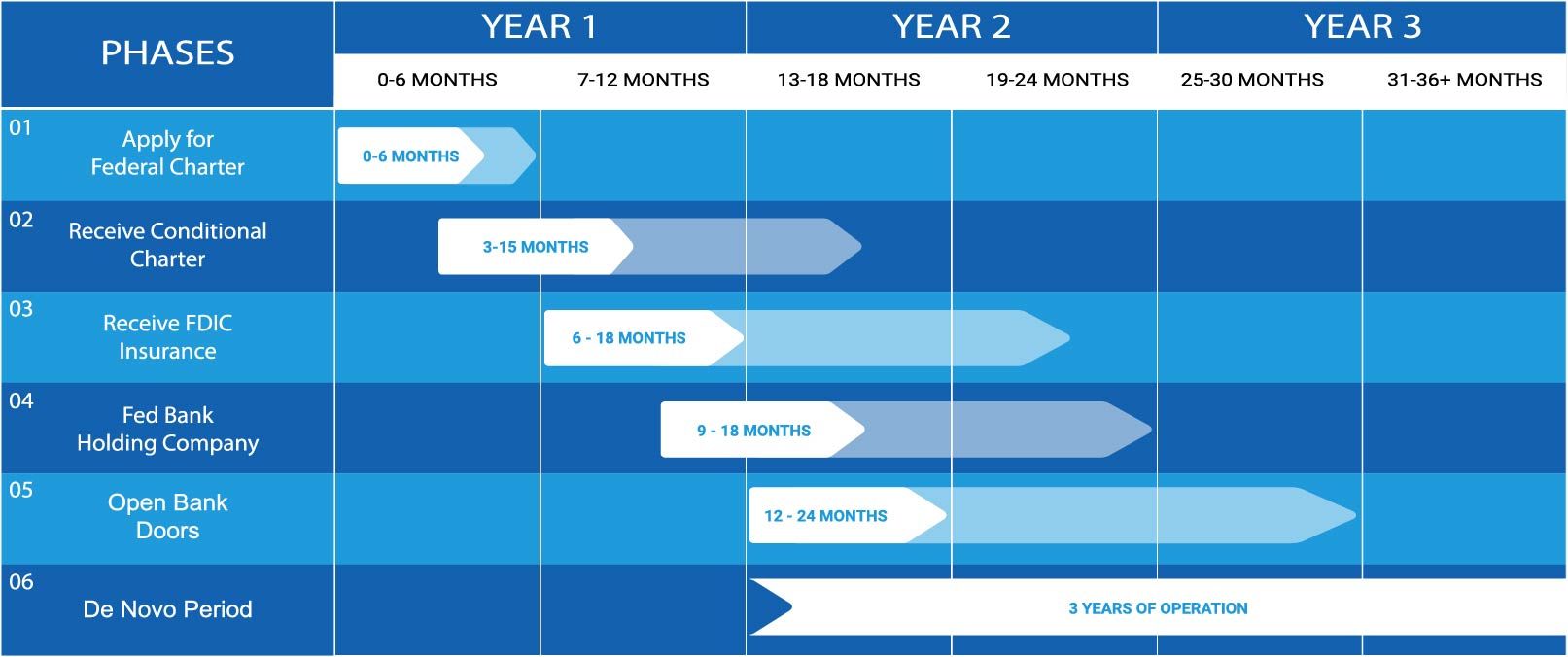

How long does it take to get a bank charter?

The general rule of thumb is that this entire process, from application submission until a bank can open its doors, can take up to 24 months. However, based on the strength of our application, our goal is to receive our conditional charter within 6-9 months from submission. We aim to accelerate the final approval stages, opening the doors of the bank for regular operations 6-9 months after conditional charter approval.

What is Analog's exit strategy?

Our long-term plan is a focused path toward an Initial Public Offering (IPO), as this represents the most controllable exit outcome for our investors. We are targeting the public offering when the banks assets total $50 - $100 billion. The goal is to be valued similarly to other tech-forward financial banking institutions, like NuBank and Revolut. This means achieving a market capitalization that is greater than or equal to the total assets of the institution.

FUNDRAISE

$75 Million

Formation Reserve Capital

$300 Million

Pre Money Cap SAFE Note

Funds from formation reserve capital are required for the charter application process. Until conditional approval is granted, these funds will be invested in cash and short-term U.S. treasuries. Once conditional charter approval is received, Analog will use the reserve capital for statutory purposes and banking operations. If Analog fails to obtain conditional charter approval, reserve capital investors will receive their principal investment, plus any accrued interest minus expenses.

Administration

Reserve assets and treasuries will be managed by a top bank

Corporate Audits

Corporation and reserve assets will be audited by a top 25 US audit and tax firm

INVESTMENT QUESTIONS

What is the maximum investment?

The maximum investment is $15 million to avoid the challenges associated with Beneficial Ownership Reporting rules. Investors with less than 5% ownership avoid public reporting requirements.

How will you pay for the bank charter?

We will raise an additional $15 million in operating capital to fund the application process through the Operating SAFE note. Investors participate in the Operating SAFE at a discount.

Why a SAFE note?

SAFE notes allow us to raise the reserve capital and operating capital concurrently. Additionally, a SAFE note is better structured for returning investor capital in the event we are unable to receive our conditional charter.

Why are there no voting rights?

No voting rights enables us to raise capital from foreign investors while avoiding the restrictions associated with foreign ownership of a U.S. bank. Furthermore, this enables domestic investors to sell secondaries to foreign entities in the future.

What are the expenses associated with the reserve capital SAFE?

Expenses include third party asset management, annual audit, quarterly review, brokerage, distribution, and administration fees.

What are the KYC requirements to Invest?

Investors must pass a KYC/AML check with our third party partner.

INVESTMENT DOCUMENTS

REGULATORY

CHARTER ROADMAP

REGULATORY QUESTIONS

What is a "de novo" bank?

A "de novo" bank is a bank that has been newly chartered, not including charter acquisitions. The term "de novo" is Latin for "from the beginning," signifying that the bank is starting from scratch. All de novo banks are required to complete a chartering process with their corresponding regulator. In our case, that agency is the Office of the Comptroller of the Currency (OCC). De novo banks are often established to fill a niche in the market or introduce innovative financial products and services.

What are the regulatory requirements to open a bank?

The bank needs three key approvals: a charter from the OCC (Office of the Comptroller of the Currency), FDIC Insurance (Federal Deposit Insurance Corporation), and a Fed Master Account (The Federal Reserve).

What are the capital requirements to open a bank?

There is no official minimum to charter a bank; however, for a federal bank charter application to be taken seriously the typical minimum amount of capital required is in the $50 - $60 million range. We are raising $75 million.

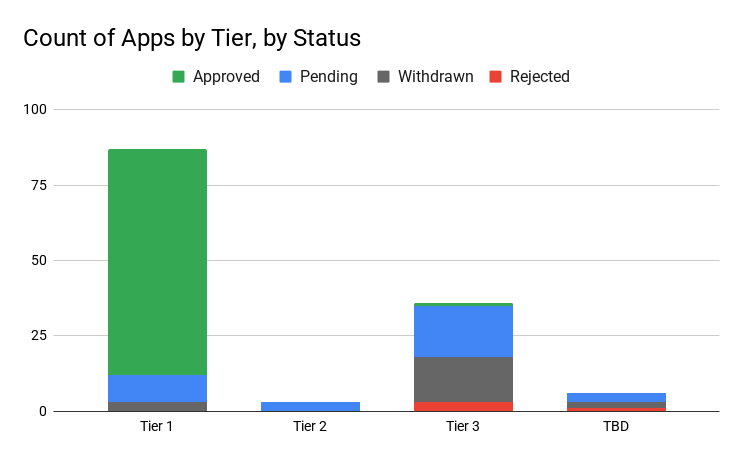

What type of charter will you apply for?

There are variations and types of charters including federal, state, trust, ILC, credit card, and both insured and non-insured institutions. Charter applications are rated as Tier 1, 2, or 3 charters. We are pursuing a federally insured Tier 1 banking charter.

Why are you not applying for a state charter?

A state chartered "full reserve" bank would likely be considered a Tier 3 entity. On average, Tier 3 applications received decisions in 823 days with only one Tier 3 charter receiving approval. On the other hand, Tier 1 applications received a decision in 94 calendar days, with 86% receiving approval.

Why does Analog need FDIC insurance?

Securing FDIC insurance is a fundamental requirement for any institution seeking to operate as a Tier 1 national bank in the United States. Our association with the FDIC immediately signals to clients that we are part of this trusted framework of safety and soundness. For a bank built on the principle of unparalleled security, FDIC insurance is a vital component of our commitment to our clients.

A lot of companies are applying for bank charters. How does Analog fit into this trend?

While it's true that many tech companies like Stripe and Circle are pursuing limited charters, their primary goal is often to support an existing business like payments or stablecoins. Analog is different because we are not "bolting on" a banking license as an augmentation to the existing product feature set. We are a innovative bank at our very core, built from the ground up with a risk-focused mission to solve problems within the banking system itself. We are seeking a Tier 1 federal charter with the express purpose of becoming a pillar of financial stability, not just an adjunct to another business.

With the passage of the Genius ACT will you offer a stablecoin?

Following a development like the Genius Act, our strategy regarding stablecoins is not to issue a stablecoin ourselves but to serve as a banking partner for the ecosystem. We plan to be the on and off ramps for the specialized trusts that will issue stablecoins. This role is critical because these issuers are generally restricted from providing the depository and payment services necessary to move between digital assets and U.S. dollars. By focusing on this core banking infrastructure we enable the broader stablecoin ecosystem to flourish.

FINANCIALS

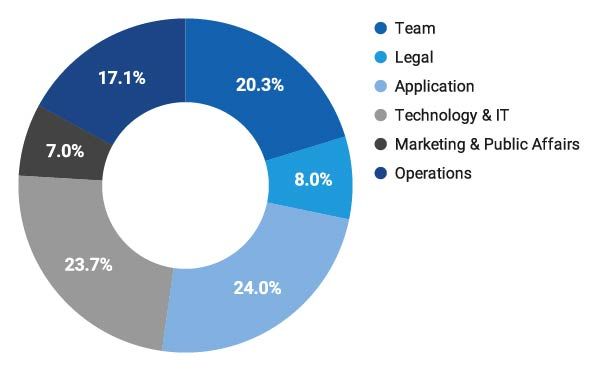

APPLICATION PERIOD

| Type | 24mo Expenses |

|---|---|

| APPLICATION TEAM | $3,039,000 |

| LEGAL | $1,200,000 |

| APPLICATION | $3,600,000 |

| TECHNOLOGY & IT | $3,552,000 |

| MARKETING & PUBLIC AFFAIRS | $1,050,000 |

| OPERATIONS | $2,559,000 |

| TOTAL | $15,000,000 |

De Novo Period

| Year | 1 | 2 | 3 | TOTAL |

|---|---|---|---|---|

| MANAGED ASSETS | 4,000,000,000 | 6,000,000,000 | 9,000,000,000 | 9,000,000,000 |

| HEAD COUNT | 40 | 60 | 90 | 90 |

| - | ||||

| FEE BASED | 11,926,035 | 30,480,329 | 45,889,413 | 88,295,777 |

| ASSET BASED | 37,829,929 | 93,390,101 | 137,144,102 | 268,364,132 |

| TOTAL REVENUE | 49,755,964 | 123,870,430 | 183,033,515 | 356,659,908 |

| - | ||||

| PRODUCT | 6,956,000 | 9,697,896 | 12,731,917 | 29,385,813 |

| OPERATIONS | 1,728,000 | 2,452,576 | 3,430,576 | 7,611,152 |

| LEGAL AND CONSULTING | 3,000,000 | 3,120,000 | 3,300,000 | 9,420,000 |

| TECHNOLOGY & IT | 3,732,000 | 5,040,744 | 6,948,577 | 15,721,321 |

| COMPLIANCE | 3,320,625 | 6,628,305 | 9,720,606 | 19,669,536 |

| MARKETING AND PUBLIC AFFAIRS | 1,285,000 | 1,750,800 | 2,383,400 | 5,419,200 |

| TOTAL EXPENSES | 20,021,625 | 28,690,321 | 38,515,076 | 87,227,021 |

| - | ||||

| NET PROFITS | 29,734,339 | 95,180,109 | 144,518,439 | 269,432,887 |

Notes:

1) Community Bank Regulatory Supervision (<$10B)

2) 60% Demand Deposits to 40% Term Deposit or equivalent

3) 1% Average AUM fee on wealth management services

4) Assumes 300bps core IORB

5) Assumes 30bps on all other assets

6) Maximum FDIC allow "de novo" growth

7) FIDC Insurance based on risk rates without adjustments

8) Interchange assumes Durbin Rule rates for above $10B institution

9) Net profits will be reinvested in asset growth and balance sheet loans

10) Wealth management as a percentage of total assets grows to 15%

11) Wealth management no fees on cash AUM

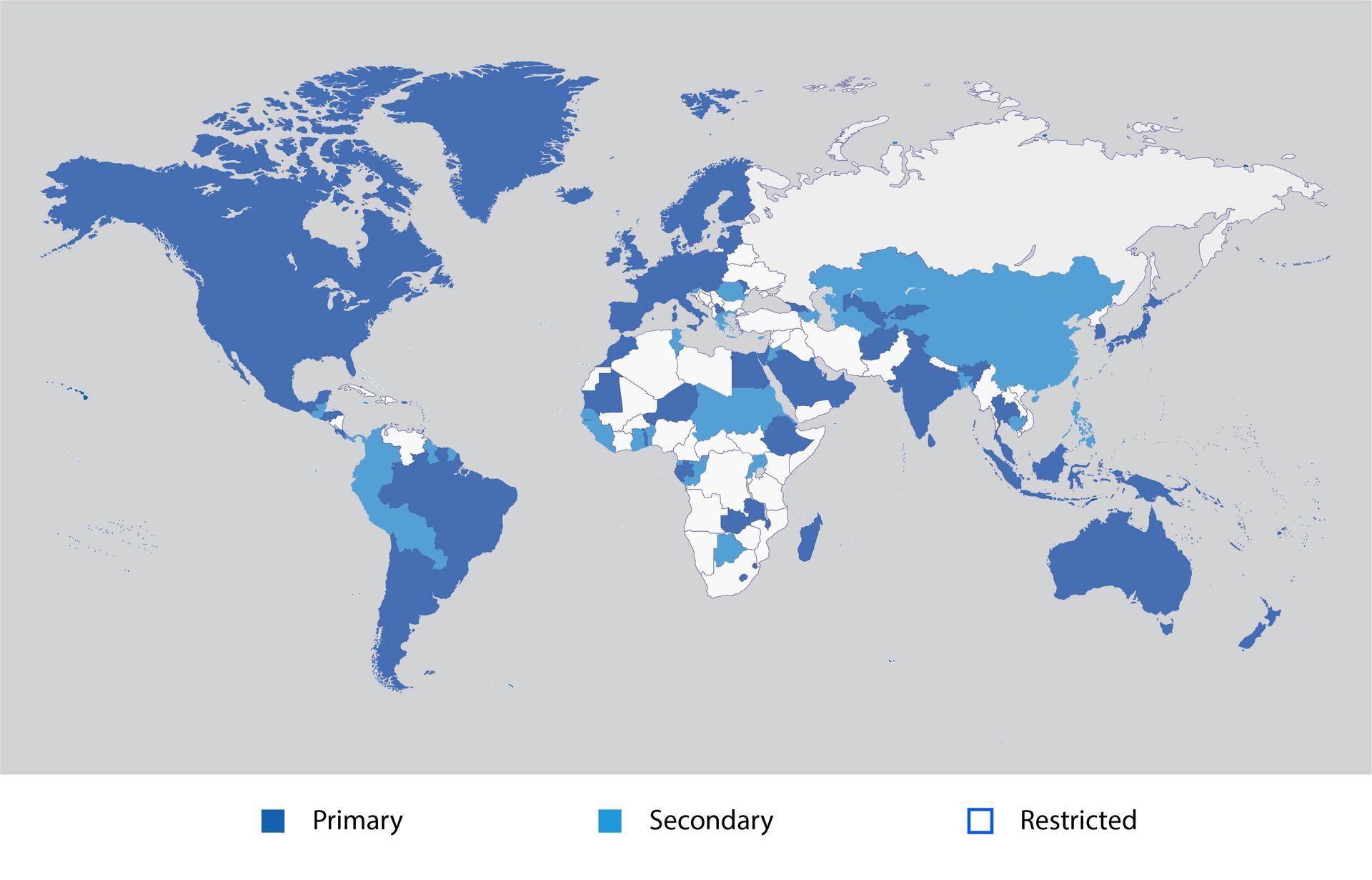

MARKET

COUNTRIES

| Primary Territories | ||||

|---|---|---|---|---|

| Andorra | Anguilla | Argentina | Aruba | Australia |

| Austria | Bahrain | Belgium | Bermuda | Bhutan |

| Brazil | British Virgin Islands | Brunei | Cabo Verde | Canada |

| Cape Verde | Cayman Islands | Chile | Cook Islands | Costa Rica |

| Curaçao | Czech Republic | Denmark | Djibouti | Dominica |

| Egypt | El Salvador | Estonia | Eswatini | Ethiopia |

| Fiji | Finland | France | French Polynesia | Gabon |

| Gambia | Georgia | Germany | Greenland | Grenada |

| Guam | Hungary | Iceland | India | Indonesia |

| Ireland | Israel | Italy | Japan | Kiribati |

| Kosovo | Kuwait | Kyrgyzstan | Latvia | Lesotho |

| Liechtenstein | Lithuania | Luxembourg | Macau | Madagascar |

| Malawi | Malaysia | Maldives | Marshall Islands | Mauritania |

| Mexico | Micronesia | Moldova | Montserrat | Nauru |

| Netherlands | New Caledonia | New Zealand | Niger | North Macedonia |

| Northern Mariana Islands | Norway | Oman | Palau | Papua New Guinea |

| Peru | Poland | Portugal | Puerto Rico | Qatar |

| Rwanda | Saint Kitts and Nevis | Saint Lucia | Saint Vincent and the Grenadines | Samoa |

| San Marino | Sao Tome & Principe | Saudi Arabia | Seychelles | Singapore |

| Sint Maarten | Slovakia | Solomon Islands | South Korea | Spain |

| Sri Lanka | St. Kitts and Nevis | St. Lucia | St. Vincent and The Grenadines | Suriname |

| Sweden | Switzerland | Taiwan | Thailand | Timor-Leste |

| Togo | Tonga | Trinidad and Tobago | Turks and Caicos Islands | Tuvalu |

| United Arab Emirates | United Kingdom | United States | Uruguay | Uzbekistan |

| Vanuatu | Zambia | Zanzibar |

| Secondary Territories | ||||

|---|---|---|---|---|

| Afghanistan | Antigua and Barbuda | Armenia | Azerbaijan | Bahamas |

| Bangladesh | Barbados | Belize | Benin | Bolivia |

| Botswana | Cambodia | Chad | China | Colombia |

| Comoros | Congo | Cyprus | Ecuador | Equatorial Guinea |

| Eritrea | Ghana | Greece | Guatemala | Guinea |

| Guinea-Bissau | Guyana | Honduras | Hong Kong | Jamaica |

| Jordan | Kazakhstan | Liberia | Macao | Malta |

| Mauritius | Mongolia | Morocco | Panama | Paraguay |

| Philippines | Romania | Senegal | Sierra Leone | Slovenia |

| Sudan | Tajikistan | Tunisia | Turkmenistan | Uganda |

| Restricted Territories | ||||

|---|---|---|---|---|

| Albania | Algeria | Angola | Belarus | Bosnia and Herzegovina |

| Bulgaria | Burkina Faso | Burundi | Cameroon | Central African Republic |

| Croatia | Cuba | Dominican Republic | DR Congo | Haiti |

| Iran | Iraq | Ivory Coast | Kenya | Laos |

| Lebanon | Libya | Mali | Monaco | Montenegro |

| Mozambique | Myanmar | Namibia | Nepal | Nicaragua |

| Nigeria | North Korea | Pakistan | Russia | Serbia |

| Somalia | South Africa | South Sudan | Syria | Tanzania |

| Turkey | Ukraine | Venezuela | Vietnam | Yemen |

| Zimbabwe |

CUSTOMER PERSONAS

High Net Worth Client

Jessica

Jessica is a successful entrepreneur with a successful exit here in the U.S. where she holds 6% of her assets in cash totaling $10M. She spreads that money across 10+ banks with 3 million at a top 5 bank to stay near the FDIC limits. Since the 2023 Banking Crisis she has concern about the stability of her banks. Analog enables Jessica to consolidate her cash into one account, simultaneously eliminating the operational headache of managing multiple accounts and the systemic risk.

Startup CFO

James

James is the CFO of a fast-growing startup with $25M in cash. His treasury team spends hours managing sweep accounts. With Analog, James now splits his cash between Analog and a top 5 bank. He gets the same level of service with a new level of security. Now James can sleep well at night knowing he will always be able to make payroll. His team can shift their focus to creating value rather than managing risk.

International Parent

Ji Hoon

Ji Hoon is from South Korea. He's concerned about the long-term devaluation of his local currency and he wants to invest in the United States. He also wants to support his son who is starting his second year at Harvard. Ji Hoon is concerned with depositing $84,000 directly to his son's account because he lost $20,000 gambling during his freshman year. Analog gives him a secure place to deposit money in the U.S., pay for tuition directly, and send funds for monthly expense. For Ji Hoon, Analog is a way to financially support his family's educational pursuits through a direct gateway to the U.S. financial system.

MARKET QUESTIONS

Who are your target customers?

Analog will target corporations, family offices, funds, and high-net-worth individuals, particularly those with uninsured deposits.

How will Analog offer bank accounts in over 120 countries?

Onboarding international customers requires a more robust Know Your Customer (KYC) and Anti-Money Laundering (AML) process. Traditional banks are often hesitant to implement these higher standards because applying them across their entire customer base would be disruptive and could negatively impact their capital reserve ratios when fraudulent accounts are inevitably identified and closed. Analog is building compliance infrastructure, design by our advisors who are experts in the field, allowing us to confidently serve a global clientele without compromising our standards or business model.

How do you target International customers?

Our international growth strategy is not based on direct advertising in foreign jurisdictions, but rather on organic expansion driven by social referrals from our existing clientele. We are tapping into a significant pent-up demand from individuals globally who have historically been seeking direct access to the U.S. financial system. The explosive growth of the stablecoin market from roughly $5 billion in 2019 to over $200 billion in 2025 serves as a powerful indicator for this demand. We offer these clients a more direct and regulated pathway to the U.S. dollar, upgrading them from a derivative to a foundational financial relationship.

How do foreign capital restrictions affect international customers?

While international customers are subject to the capital export controls of their home countries, our services provide a transformative advantage. These regulations may limit the total amount of funds a client can move abroad, but they do not prevent them from opening an account with us. This means that regardless of their country's specific limits, clients gain direct access to the U.S. financial system, often for the very first time. Even with a fraction of their wealth, they can establish a secure U.S. dollar-denominated account, providing a crucial gateway to financial stability and diversification.

How do you plan to attract corporate customers?

Our strategy for attracting corporate customers is to provide a treasury management solution directly to the CFO. We solve the critical challenge of managing counterparty risk for corporate cash held in excess of standard FDIC insurance limits. A CFO can effectively hedge this risk by placing all, or even just a portion, of their excess operating cash in our 100% backed demand accounts. Our goal is not to capture 100% of a client's deposits; our model finds great success even if a corporation entrusts us with a fraction of its funds for safekeeping.

Why do you think you can grow faster than a traditional bank?

Our ability to grow faster than a traditional bank is rooted in a fundamental structural advantage. Traditional fractional-reserve banks are constrained because their loan operations do not scale linearly. Additionally, rapid asset growth is a red flag for institutional risk that draws intense regulatory scrutiny. In contrast, our growth is driven by lean and scalable treasury operations, which avoids the systemic risk that concerns regulators. This model enables the same small, expert team to effectively manage assets of $1 billion or $10 billion. This enables us to grow faster and with less regulatory friction.

TECHNOLOGY

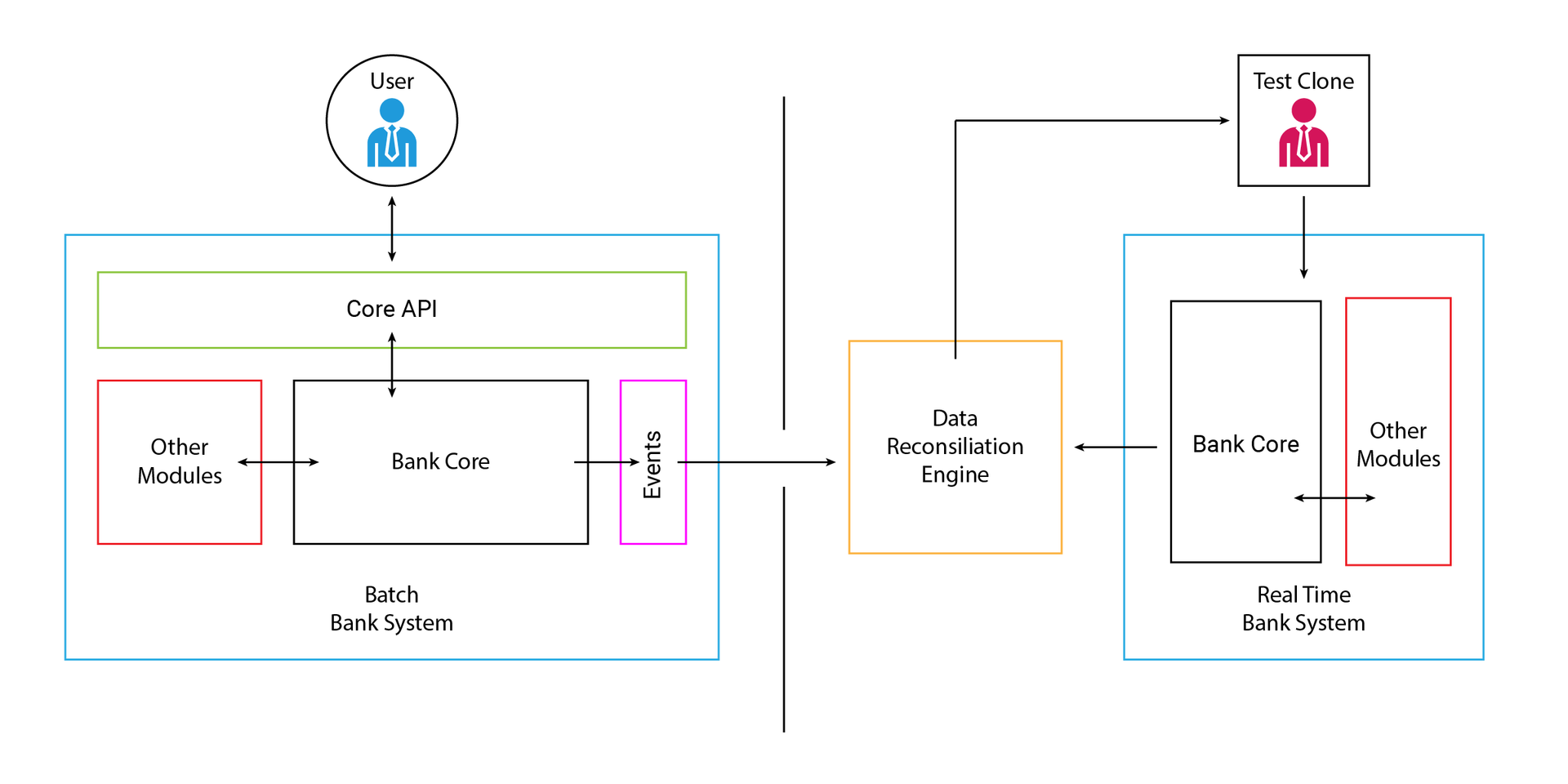

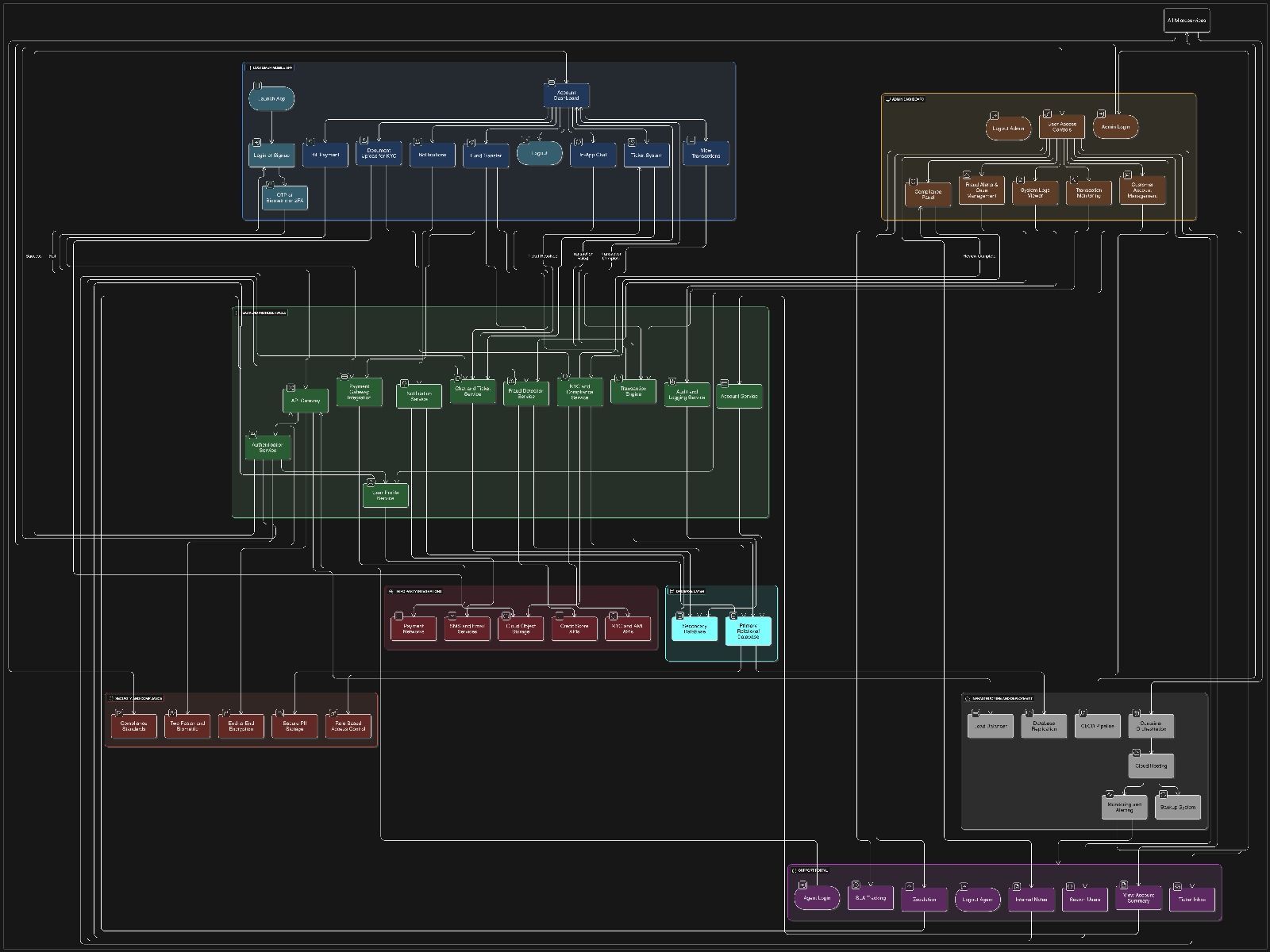

INITIAL PARALLEL ARCHTECTURE

OWL

Technology FAQ's

Why build your own banking core in parallel to the vendor licensed core?

Banks need regulatory approval to implement custom cores. Analog will develop and run its own banking core in parallel to a large third party provider. Once it has been demonstrated that our technology can meet the same standards as that of a major existing banking core, Analog will over time seek approval to migrate to our own systems.

Who will provide the traditional core?

We will work with either FIS or Fiserv. These vendors have built a reputation of trust with the regulators over decades. Historically, other vendor options can cause delays in the charter application process.

Documents

Engagement Letters & Partnerships

Notes:

Partnership proposal deck for Klaros Group. Klaros Group is a financial services advisory and investment firm that provides strategic guidance to banks, fintech companies, and investors.

Notes:

Gilmore Group introductory deck. Gilmore Group is a strategic design firm that partners with global brands to create immersive customer experiences by integrating branding, industrial design, and digital interaction.

Notes:

Citizens Private Bank proposal deck for treasury management services for the reserve capital fundraise.